Slack released their S-1 today, and as usual with SaaS companies I took time to read through it. I do not usually do write ups on S-1’s, in fact, this is my first one.

As I read through it there were some interesting learnings worth calling out, especially around their strategy.

Here are a few takeaways:

Global Expansion

I knew they had users around the world. But 600,000 organizations in over 150 countries is about 100 more countries than I would have guessed. And not just countries, but they have active users in nearly every major country in the world.

They have established international offices, including offices in Australia, Canada, Ireland, India, Japan, and the United Kingdom, and plan to continue to expand international operations in the future.

Developers Galore

The Slack community includes 500,000 registered developers. Developers have collectively created more than 450,000 third-party applications for Slack to-date that are active, meaning used in an average week at least once.

As you read through the S-1, it’s clear that Slack’s strategy is a more multi-dimensional approach than you might think. It is as much about apps and files as it is about remote team communication. And that brings me to my next point…

Slack is an Aggregator

The positioning by Slack in their S-1 around aggregating other apps was brilliant. And they backed it up with stats that make your eyes roll as a SaaS leader. For example, according to their S-1, Slack says a typical enterprise uses more than 1,000 cloud services.

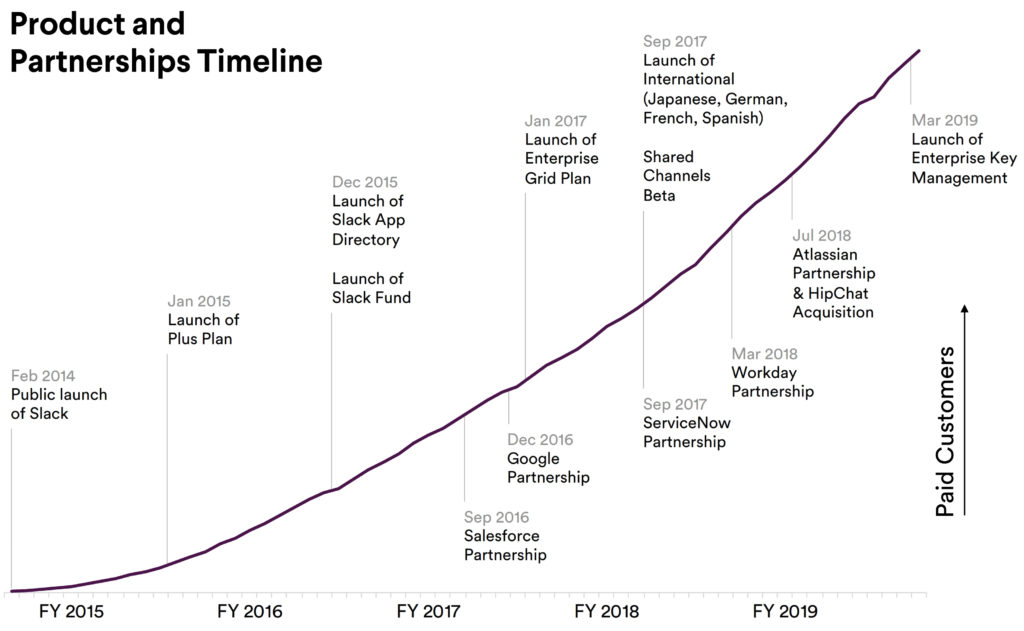

If you continue reading the S-1, you can clearly see this strategy come into play looking at their partnerships. They are adding major data sources in enterprise companies that allow them to more easily aggregate information as a centralized hub.

This gives Slack a second competitive advantage, not just as a hub for communication, but as a centralized aggregator of other cloud-based tools in large enterprises. Talk about sticky.

Mega Engagement

50 million hours. That’s how much time Slack users spend on Slack in a given week. During the week ending January 31, 2019, more than 1 billion messages were sent in Slack.

During this same time, on a typical workday, users at paid customers averaged nine hours connected to Slack through at least one device. They also spent more than 90 minutes actively using Slack. Compare that to YouTube’s 40 minute daily average viewing, and you can really start to put this data into context.

Efficiency at Scale

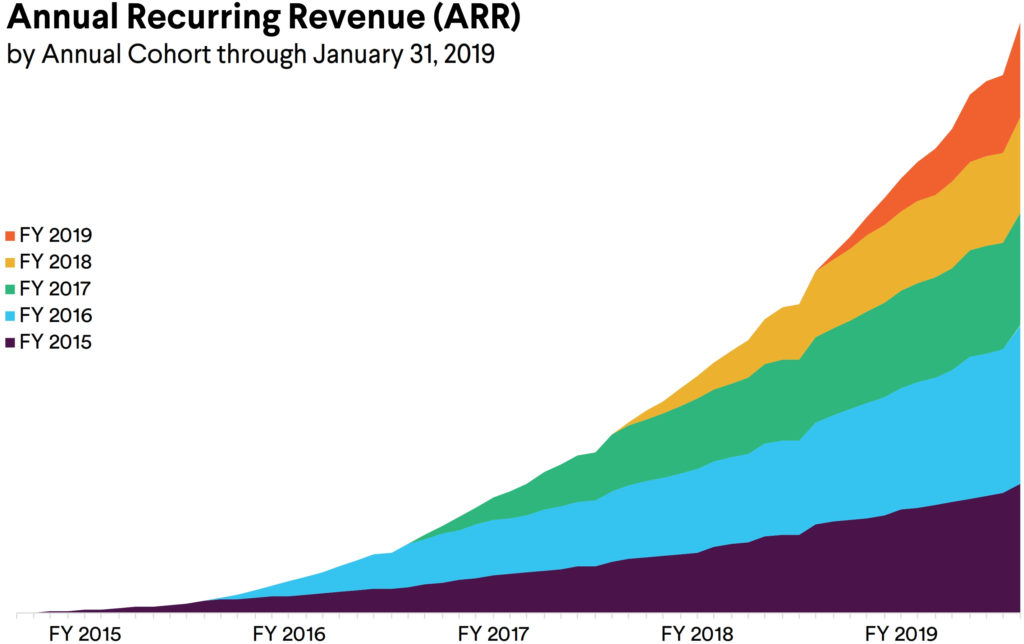

Unlike many other hyper-growth technology companies, Slack has managed to keep losses flat while maintaining growth. Revenue was $105.2 million, $220.5 million, and $400.6 million in 2017, 2018, and 2019, respectively.

In comparison, net losses were relatively flat/down at $146.9 million, $140.1 million, and $138.9 million in 2017, 2018, and 2019, respectively.

Organic vs. Paid Marketing

Sales and marketing expenses have increased, but not nearly as much as revenue. This is a credit to the Slack organic growth model they tout throughout their S-1. Organic growth is generated as users realize the benefits of Slack. And in turn they will always spend less on marketing than other technology companies.

Enterprise Grade

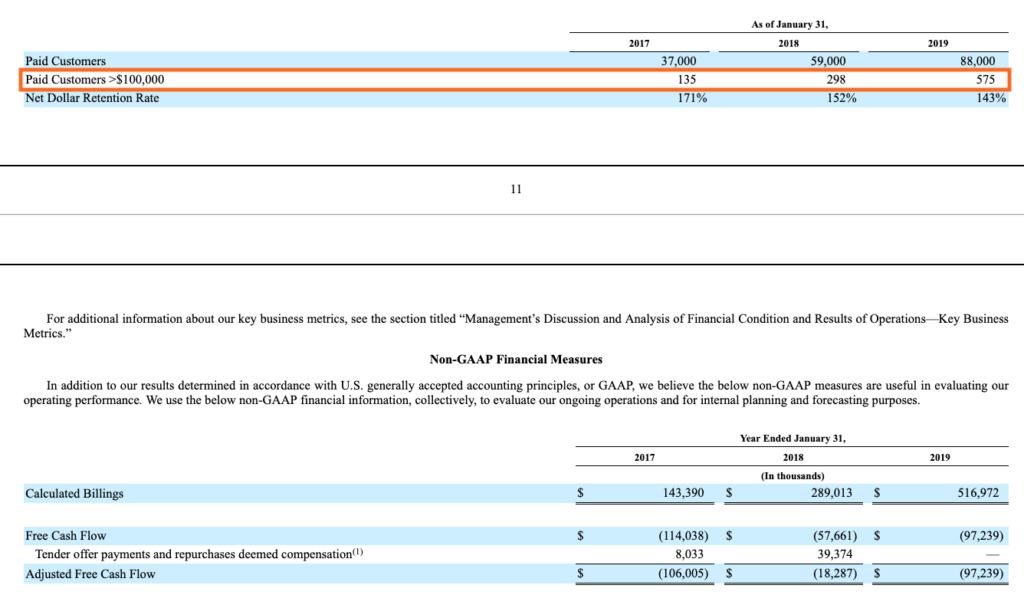

Slack may be a fun and energetic brand, but make no mistake, they are an enterprise SaaS company. Over the last 2 years they have seen total customers increase roughly 2x, but 100k customers increase more than 4x.

You can see this in the incredible case studies they have from companies like Oracle and Splunk. These are listed near the end of the S-1, definitely check them out.

I found the Oracle one particularly interesting. Oracle has over 1,100 Slack apps installed and their team churns through 18,000 file uploads daily. That is the equivalent of roughy 4 files uploaded per person to Slack each day. When you see the combined user adoption, wide app integrations, and voracious daily file uploads, the enterprise value is obvious.

Major League Competitors

I love the competitors Slack lists in their S-1. First, they state their primary competitor as Microsoft. This is likely due to O365 having a similar aggregator model. And it makes total sense when you read their ultimate vision (see the previous section on Slack as an aggregator).

Don’t sleep on Office 365. It has quickly grown into a central hub for many organizations at scale, and is surprisingly well integrated with other apps. Slack also lists other communication and productivity tools like Alphabet, Cisco, and Facebook. But those comparisons are not nearly as interesting as their juxtaposition against MSFT.

Another Reason to Buy AMZN

Speaking of stock tickers like MSFT, buy some AMZN. Like so many other SaaS platforms, Slack is built on AWS. And it enables them to order and reserve server capacity in varying amounts and sizes distributed across multiple regions. Slack is pretty clear that they are dependent on the Amazon cloud. This follows another high-profile IPO company Lyft who will be spending $300M on AWS through 2021.

Hopefully this provided some insights into Slack’s upcoming IPO without having to dig through too much of their S-1. At the end of the day, I will definitely try to pick up some shares after the IPO based on what I read this morning.